how much federal taxes deducted from paycheck nc

Thanks to that reduction in taxes increasing your contribution wont take as much of a bite from your paycheck as you might think. Businesses must also report how much federal payroll tax they withheld and paid throughout the year.

Pin By Tiffany Solano On Unlock Payroll Template Money Template Printable Tags Template

Thats how long it could take for your benefits to start up again according to Pennsylvanias Department of Labor.

. Thank you for your service to the people of North Carolina and we look forward to working with you. If you are self-employed and pay both the employer and employee Medicare tax the employer portion of the tax is deductible. Dental plan premiums are deducted from your paycheck on a pre-tax basis in the same month coverage is effective.

I was an F1 student and worked in OPT last few months. Individual Income Tax Return. File a Complaint About a Debt Collector Report any problems you have with a debt collection company to your State Attorney Generals Office the Federal Trade Commission FTC and the Consumer Financial Protection.

Threaten to have money deducted from your paycheck or to sue you unless the collection agency or creditor intends to do so and it is legal. JANUARY 2019 Your Retirement Benefits 3 MEMBER HANDBOOK LOCAL GOVERNMENTAL EMPLOYEES RETIREMENT. FUTA taxes are reported annually.

Compute the tax using the aggregate method option 2. That amount is then withheld from your bonus for federal taxes. You make 30 times hourly federal minimum wage per week gross income you would get if you worked 30 hours a week at minimum wage before expenses If you do not fulfill this requirement or have a different exemption you could be forced to apply for jobs after three months on SNAP benefits if you are an able-bodied adult without dependents ABAWD aged 18 to 49.

Thanks to federal tax breaks its now more affordable for small businesses to set up a retirement plan for their employees. For example lets assume you had a bonus of 5000. But it has to be made every paycheck.

Each entity has to be paid separately by check or electronic payment. For FICA taxes this is typically done quarterly but in some instances where the total tax liability is small it may be done annually. If you earn 75000 a year for example a 5 percent contribution to your 401k would put 144 into your account assuming a 25 percent tax rate.

I am an exception from FICA but my owner still deducted from FICA. This means your premiums are taken from gross pay before Social Security federal and state taxes are deducted which reduces your taxable income. If you are a W-2 wage earner Medicare payroll taxes are not an allowable tax deduction for you.

Individuals who do not have income tax automatically deducted from their paycheck may be required to send quarterly income tax payments using Form AR1000ES to the Arkansas Department of Finance and Administration. State payroll tax deposit and filing procedures vary by state. Your employer would withhold a straight 1100 22 from this amount.

But your biweekly paycheck will fall by just 108 according to Fidelity Investments. The full credit can be claimed by married joint filers with modified adjusted gross income MAGI of up to 150000 single filers with MAGI of up to 75000 and heads of household with MAGI of up to 112500. Arkansas Form AR1000F must be filed by all qualifying taxpayers yearly.

Box 1 will show the benefits received and Box 4 will show the federal income taxes withheld. Once people start seeing how much is actually deducted and having to. I submitted my Federal tax 1040NR-EZ and EZ and 8843 with FICA tax 8316843 1040NR-EZ and 8843 since March 29 2019.

This is separate and apart from your regular paycheck which would remain the same as usual. Companies with 100 or fewer employees other conditions apply can get a maximum tax credit of 500 every year for the first three years after starting a retirement plan such as a 401K Savings Incentive Match Plan for Employees SIMPLE IRA or. While 888-313-7284 is Pennsylvania Unemployment Claimss best toll-free number there are 3 total ways to get in touch with them.

I think we should all demand a bill that would eliminate taxes taken directly from your paycheck. Individuals with simple tax. Medicare payroll taxes are deducted in calculating your take-home pay from an employer.

The child tax credit for 2021 is 3600 for each child under age 6 and 3000 for each child ages 6 to 17. This is calculated on Schedule SE. If there is a third bi-weekly paycheck in the month the premium is not deducted.

You will get a check or a direct deposit as well as a notification of what taxes are required.

North Carolina Income Tax Calculator Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

North Carolina Income Tax Calculator Smartasset

Payroll Software Solution For North Carolina Small Business

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

How To Calculate Payroll Taxes For Your Small Business The Blueprint

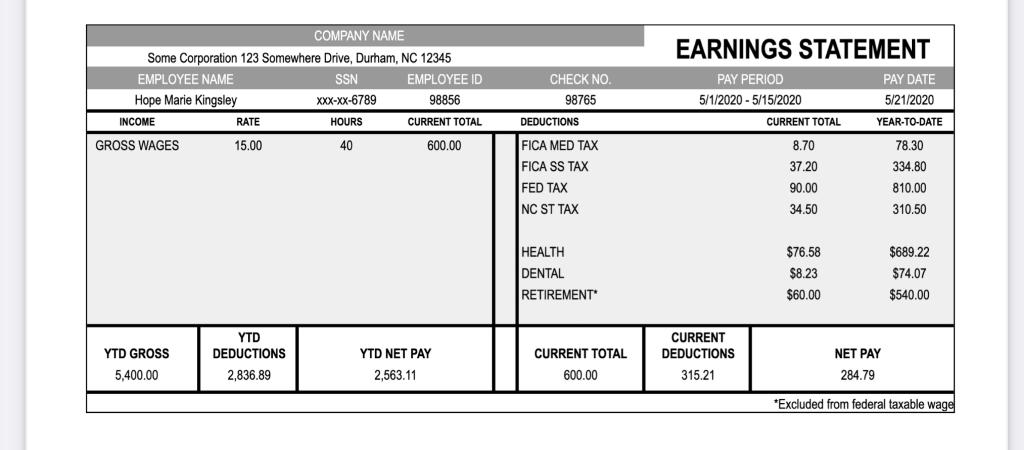

Solved Earnings Statement Company Name Some Corporation 123 Chegg Com